The BC Speculation Tax - Facts Figures & The Truth

(August 17, 2018

)

What is the NDP's BC Speculation Tax? Well first of all it's not "really" a tax, it's a political stunt and a redistribution  of wealth scheme. That said, here is our explanation of the above in its current form which could be altered by the NDP

of wealth scheme. That said, here is our explanation of the above in its current form which could be altered by the NDP

at any time.

of wealth scheme. That said, here is our explanation of the above in its current form which could be altered by the NDP

of wealth scheme. That said, here is our explanation of the above in its current form which could be altered by the NDP at any time.

Agree or not, make sure you know if you will be affected..

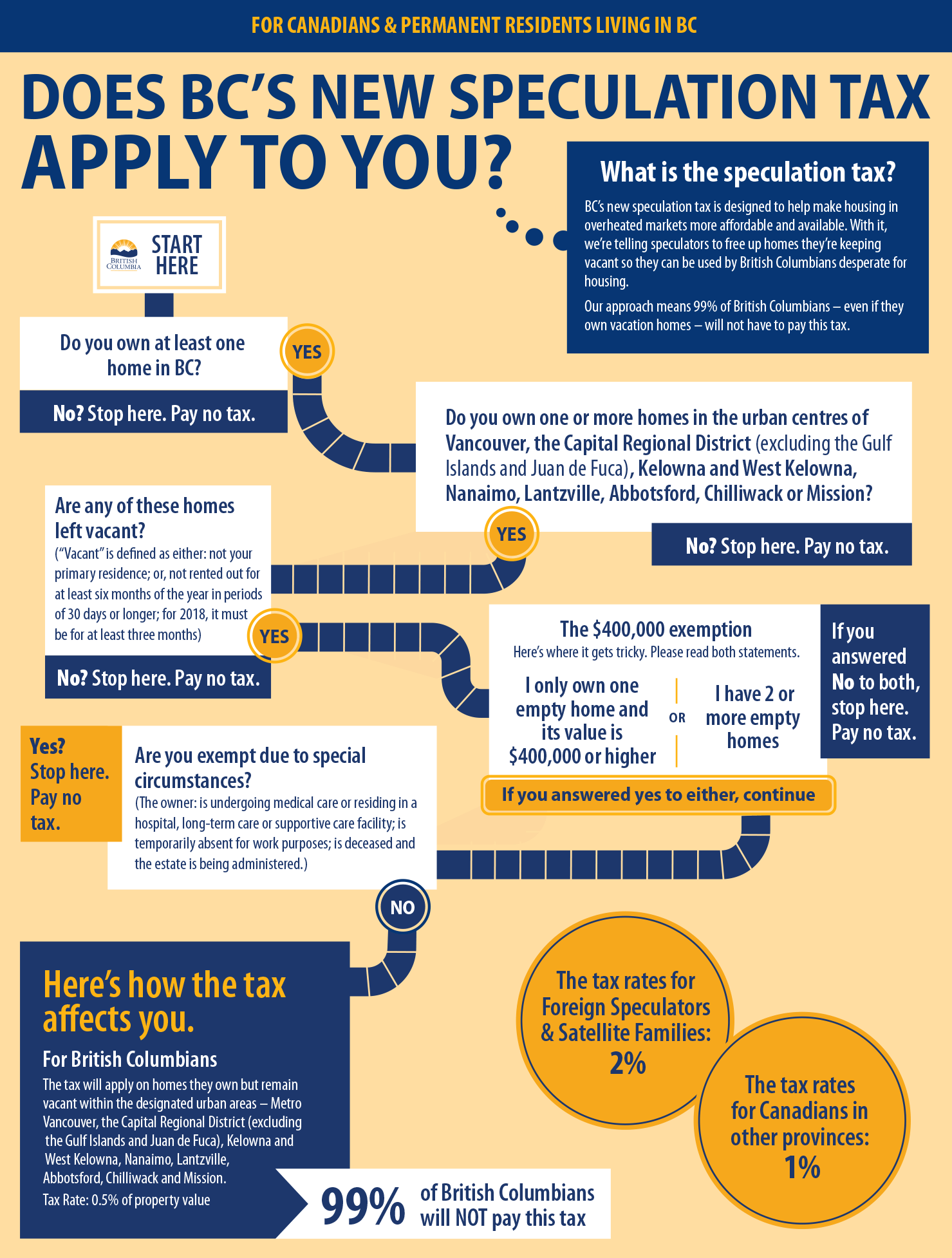

What areas are covered you ask?

The speculation tax applies only in BC’s largest urban centres: Metro Vancouver, the Capital Regional District (excluding the Gulf Islands and Juan de Fuca), Kelowna and West Kelowna, Nanaimo-Lantzville, Abbotsford, Chilliwack and Mission.

What areas are covered you ask?

The speculation tax applies only in BC’s largest urban centres: Metro Vancouver, the Capital Regional District (excluding the Gulf Islands and Juan de Fuca), Kelowna and West Kelowna, Nanaimo-Lantzville, Abbotsford, Chilliwack and Mission.

Who Pays the Tax?

Foreign speculators (households with high worldwide income that pay little income tax in BC). They pay the tax because they are NOT eligible for primary residency exemption.

Canadians or permanent residents who live in BC; will pay tax on homes that are empty within designated areas.

Canadian or permanent residents who live outside BC: if the home they own is in the designated area is NOT their primary residence, and is NOT rented out out for at LEAST 6 months of the year, they will pay the tax.

Foreign speculators (households with high worldwide income that pay little income tax in BC). They pay the tax because they are NOT eligible for primary residency exemption.

Canadians or permanent residents who live in BC; will pay tax on homes that are empty within designated areas.

Canadian or permanent residents who live outside BC: if the home they own is in the designated area is NOT their primary residence, and is NOT rented out out for at LEAST 6 months of the year, they will pay the tax.

Who Doesn’t Pay the Tax?

An estimated 99% of British Columbians won’t pay the tax:

Own the home and live in it (primary residence)

If you are a renter

Own a second home and rent it out for at lest 6 months of the year.

If the home is vacant but outside the designated urban area –Metro Vancouver, the Capital Regional District (excluding the Gulf Islands and Juan de Fuca), Kelowna and West Kelowna, Nanaimo-Lantzville, Abbotsford, Chilliwack and Mission.

A vacant home, and inside the designate urban area, but is valued below $400,000.00

Of course there are special exemptions should the owner be undergoing medical care, or residing in a hospital, long-term care etc.

An estimated 99% of British Columbians won’t pay the tax:

Own the home and live in it (primary residence)

If you are a renter

Own a second home and rent it out for at lest 6 months of the year.

If the home is vacant but outside the designated urban area –Metro Vancouver, the Capital Regional District (excluding the Gulf Islands and Juan de Fuca), Kelowna and West Kelowna, Nanaimo-Lantzville, Abbotsford, Chilliwack and Mission.

A vacant home, and inside the designate urban area, but is valued below $400,000.00

Of course there are special exemptions should the owner be undergoing medical care, or residing in a hospital, long-term care etc.

How Much Is the Tax?

Residents of British Columbian – 0.5% of the property value

Canadians in other provinces – 1% of the property value

Foreign Speculators & Satellite Families – 2% of the property value.

Residents of British Columbian – 0.5% of the property value

Canadians in other provinces – 1% of the property value

Foreign Speculators & Satellite Families – 2% of the property value.

Categories

Archives

- May 2022 (1)

- November 2021 (2)

- October 2021 (3)

- July 2021 (1)

- March 2021 (1)

- April 2020 (1)

- January 2020 (1)

- October 2019 (1)

- September 2019 (1)

- August 2019 (1)

- June 2019 (1)

- April 2019 (1)

- December 2018 (1)

- August 2018 (1)

- July 2018 (1)

- June 2018 (1)

- April 2018 (1)

- March 2018 (1)

- February 2018 (2)

- January 2018 (2)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- August 2017 (3)

- June 2017 (3)

- April 2017 (3)

- March 2017 (3)

- February 2017 (1)

- January 2017 (3)

- December 2016 (4)

- November 2016 (2)

- October 2016 (3)

- August 2016 (3)

- July 2016 (1)

- June 2016 (3)

- April 2016 (3)

- March 2016 (3)

- February 2016 (10)

- January 2016 (5)

- December 2015 (1)

- November 2015 (4)

- October 2015 (3)

- September 2015 (1)

- August 2015 (3)

- July 2015 (3)

- June 2015 (10)

- May 2015 (4)

- April 2015 (9)

- March 2015 (3)

- February 2015 (5)

- January 2015 (12)

- December 2014 (7)

- November 2014 (13)

- October 2014 (13)

- September 2014 (9)

- August 2014 (4)

- July 2014 (10)

- June 2014 (12)

- May 2014 (10)

- April 2014 (5)

- March 2014 (23)

Subscribe To This Blog

Subscribe To This Blog © 2004. An independently owned and operated broker member of Sutton West Coast Realty. Each office independently owned and operated.

Sutton and Sutton West Coast are service marks of Sutton West Coast Realty and are used herein under license. Mandeep Sendher is the licensed realtor at The BC Home Hunter Group and though he is not the owner of any BCHH domains, trademarks, branding or content he assumes 100% responsibility for any and all online and offline print material, artwork, reports etc. MANDEEP SENDHER is responsible for all problems and issues including this web site or other BCHH social media platforms or electronic communication.

All photos, artwork and materials are assumed to be in the public domain unless otherwise stated. Copyright claims will be honored upon specific identification of material and immediately dealt with upon request.

The content of this website is protected by copyright law. All rights reserved. Unauthorized use in any way, shape or form is prohibited. Information is deemed reliable but is not guaranteed. Maximum care has been put into the accuracy of the content, but specifications and details should be verified by the parties involved in transactions, and we are not liable for any losses whatsoever incurred as a result of information on this website.

You are not permitted to post on or transmit to or from this web site any unlawful, threatening, libellous, defamatory, obscene, inflammatory, pornographic or profane material, or other content that could give rise to civil or criminal liability under the law.

This web site does not grant you any rights to use our trademarks, service marks, logos, artwork or trade names. The content on this site is protected by copyrights, trademarks and service marks, other intellectual property laws, and other laws and regulations.

The design, layout, graphics, photography are copyrighted and the property of THE BC HOME HUNTER GROUP, and may not be reproduced and/or used for any purposes whatsoever, without written consent. THE BC HOME HUNTER GROUP does not claim to own the rights to any or all artwork, designs, photographs etc, found on this web site or any other or any social media unless otherwise stipulated.

BCHOMEHUNTER.COM

VANCOUVERHOMEHUNTER.COM

FRASERVALLEYHOMEHUNTER.COM

NORTHVANCOUVERHOMEHUNTER.COM

WHITEROCKHOMEHUNTER.COM

LANGLEYHOMEHUNTER.COM

CLOVERDALEHOMEHUNTER.COM

WESTVANCOUVERHOMEHUNTER.COM

PITTMEADOWSHOMEHUNTER.COM

BURNABYHOMEHUNTER.COM

COQUITLAMHOMEHUNTER.COM

DELTAHOMEHUNTER.COM

MAPLERIDGEHOMEHUNTER.COM

PORTMOODYHOMEHUNTER.COM

SURREYHOMEHUNTER.COM

SOUTHSURREYHOMEHUNTER.COM

FORTLANGLEYHOMEHUNTER.COM

MORGANHEIGHTSHOMEHUNTER.COM

604LIFE.COM

© 2004. An independently owned and operated broker member of Sutton West Coast Realty. Each office independently owned and operated.

Sutton and Sutton West Coast are service marks of Sutton West Coast Realty and are used herein under license. Mandeep Sendher is the licensed realtor at The BC Home Hunter Group and though he is not the owner of any BCHH domains, trademarks, branding or content he assumes 100% responsibility for any and all online and offline print material, artwork, reports etc. MANDEEP SENDHER is responsible for all problems and issues including this web site or other BCHH social media platforms or electronic communication.

All photos, artwork and materials are assumed to be in the public domain unless otherwise stated. Copyright claims will be honored upon specific identification of material and immediately dealt with upon request.

The content of this website is protected by copyright law. All rights reserved. Unauthorized use in any way, shape or form is prohibited. Information is deemed reliable but is not guaranteed. Maximum care has been put into the accuracy of the content, but specifications and details should be verified by the parties involved in transactions, and we are not liable for any losses whatsoever incurred as a result of information on this website.

You are not permitted to post on or transmit to or from this web site any unlawful, threatening, libellous, defamatory, obscene, inflammatory, pornographic or profane material, or other content that could give rise to civil or criminal liability under the law.

This web site does not grant you any rights to use our trademarks, service marks, logos, artwork or trade names. The content on this site is protected by copyrights, trademarks and service marks, other intellectual property laws, and other laws and regulations.

The design, layout, graphics, photography are copyrighted and the property of THE BC HOME HUNTER GROUP, and may not be reproduced and/or used for any purposes whatsoever, without written consent. THE BC HOME HUNTER GROUP does not claim to own the rights to any or all artwork, designs, photographs etc, found on this web site or any other or any social media unless otherwise stipulated.

BCHOMEHUNTER.COM

VANCOUVERHOMEHUNTER.COM

FRASERVALLEYHOMEHUNTER.COM

NORTHVANCOUVERHOMEHUNTER.COM

WHITEROCKHOMEHUNTER.COM

LANGLEYHOMEHUNTER.COM

CLOVERDALEHOMEHUNTER.COM

WESTVANCOUVERHOMEHUNTER.COM

PITTMEADOWSHOMEHUNTER.COM

BURNABYHOMEHUNTER.COM

COQUITLAMHOMEHUNTER.COM

DELTAHOMEHUNTER.COM

MAPLERIDGEHOMEHUNTER.COM

PORTMOODYHOMEHUNTER.COM

SURREYHOMEHUNTER.COM

SOUTHSURREYHOMEHUNTER.COM

FORTLANGLEYHOMEHUNTER.COM

MORGANHEIGHTSHOMEHUNTER.COM

604LIFE.COM