If You Don't Own Any Real Estate - Don't Play The Blame Game Folks

(February 08, 2018

)

Welcome to another BCHH truth about real estate blog posting. Not an hour seems to go by but one of the  ountless far left Vancouver "news" media talking heads out and out attacks anyone involved in real estate, building or development. As your purveyors of BC real estate facts, not fiction here we go again folks:

ountless far left Vancouver "news" media talking heads out and out attacks anyone involved in real estate, building or development. As your purveyors of BC real estate facts, not fiction here we go again folks:

ountless far left Vancouver "news" media talking heads out and out attacks anyone involved in real estate, building or development. As your purveyors of BC real estate facts, not fiction here we go again folks:

ountless far left Vancouver "news" media talking heads out and out attacks anyone involved in real estate, building or development. As your purveyors of BC real estate facts, not fiction here we go again folks:The far left NDP/Greens/Moonbeam/radical leftist NGO coalition loves to turn the real estate market into ‘us and them’ which would be a costly mistake for our economy. Another example is the current oil/wine debacle perpetrated by the NDP and usual suspects as they shove their far left agenda down tax payers throats.

When it comes to housing, it’s not just about us and them.

Many believe that the recent rise in housing prices in Canada was fuelled, to a large extent, by foreign homebuyers (them) and not by Canadian residents (us). However, such divisive binaries do not explain all the forces at play.

A recent analysis of mortgage issuance by the CMHC revealed that the participants in housing markets in Canada involve not just us and them, but also two additional cross-over cohorts.

In addition to permanent residents, the CMHC broke out data for non-resident owners (NROs), a broader category than just foreign buyers which also includes Canadian nationals who have settled abroad, and non-permanent residents (NPRs), which comprises international students and temporary workers who live in Canada and thus contribute to our economy and society.

Many believe that the recent rise in housing prices in Canada was fuelled, to a large extent, by foreign homebuyers (them) and not by Canadian residents (us). However, such divisive binaries do not explain all the forces at play.

A recent analysis of mortgage issuance by the CMHC revealed that the participants in housing markets in Canada involve not just us and them, but also two additional cross-over cohorts.

In addition to permanent residents, the CMHC broke out data for non-resident owners (NROs), a broader category than just foreign buyers which also includes Canadian nationals who have settled abroad, and non-permanent residents (NPRs), which comprises international students and temporary workers who live in Canada and thus contribute to our economy and society.

A breakdown of NPRs revealed that in 2015 almost 52 per cent were students and 46 per cent were temporary workers, with the number of the former having doubled to 353,355 between 2006 and 2015.

NPRs are increasingly responsible for population growth in urban Canada. From 2004 to 2015, NPRs accounted for 20 per cent of the population growth in Vancouver and 11 per cent in Edmonton. Their contribution to population growth in Montreal and Toronto was slightly lower at 8.5 per cent.

The NPR contribution to population growth is even more pronounced among younger cohorts. For the period 2004-2015, NPRs accounted for 46 per cent of the growth in the 18-44-year-old demographic in Vancouver. Their share in the growth of younger cohorts stood at 42 per cent in Montreal and 28 per cent in Toronto.

With such a profound influence on the demographic makeup of large cities, NPRs are bound to have an impact on urban housing markets, and were the focus of a recent CMHC report on the influence of foreign funds in Canadian housing markets.

According to the report, the NPR share of mortgages issued in large urban housing markets has been increasing over the past ten years.

NPRs are increasingly responsible for population growth in urban Canada. From 2004 to 2015, NPRs accounted for 20 per cent of the population growth in Vancouver and 11 per cent in Edmonton. Their contribution to population growth in Montreal and Toronto was slightly lower at 8.5 per cent.

The NPR contribution to population growth is even more pronounced among younger cohorts. For the period 2004-2015, NPRs accounted for 46 per cent of the growth in the 18-44-year-old demographic in Vancouver. Their share in the growth of younger cohorts stood at 42 per cent in Montreal and 28 per cent in Toronto.

With such a profound influence on the demographic makeup of large cities, NPRs are bound to have an impact on urban housing markets, and were the focus of a recent CMHC report on the influence of foreign funds in Canadian housing markets.

According to the report, the NPR share of mortgages issued in large urban housing markets has been increasing over the past ten years.

Nearly 4 per cent of the mortgages issued in 2016 in Vancouver were held by NPRs, which was significantly higher than the share of mortgages held by non-resident owners (2.6 per cent). NPRs accounted for approximately 3 per cent of the mortgages issued in Edmonton in 2016 and 2.7 per cent in Toronto.

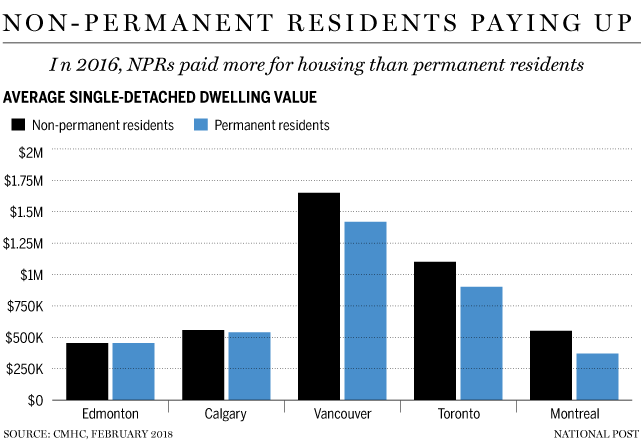

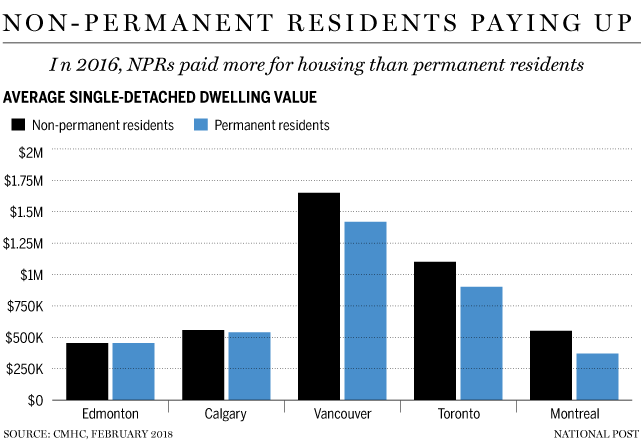

Compared to permanent residents (PR), NPRs purchased significantly more expensive housing in 2016. For example, on average NPRs paid $1,088,477 for single detached dwellings compared to $901,938 paid by PRs. In Vancouver, NPRs paid $230,000 more for single-family units than did PRs. In Montreal, NPRs paid 50 per cent more for single-detached dwellings than PRs.

The role of NPR homebuyers is even more pronounced among those under 25 years old, who are more likely to be students in Canada than temporary workers. NPRs accounted for 10 per cent of all mortgages issued in 2016 to those under 25 in Vancouver and Toronto.

The past year has witnessed a sudden and significant increase in the number of international students applying to Canadian universities and colleges. The University of Alberta, for instance, has experienced an 82 per cent increase in applications from international graduate students.

Many experts believe this to be a response to the tightening of immigration regulations in the U.S. and a reaction to the rise of ultra-right-wing movements in Europe that has made Canada more attractive to international students.

Over the past few years, provincial governments in British Columbia and Ontario moved to combat rapidly escalating housing prices by targeting punitive taxes at foreign homebuyers. A further tightening of mortgage regulations also occurred at the same time, thus slowing house price escalation and reducing the number of transactions.

While foreign homebuyer taxes target non-residents, NPRs are essentially exempted since they can ask for a rebate later after satisfying residency requirements. And while most NPRs rent, a large number do purchase housing. The mortgage data from the big five banks reported by the CMHC suggests that NPRs account for a larger share of mortgages than do NROs.

A knee-jerk response to the CMHC report might be to consider eliminating exemptions for NPRs from taxes on foreign home buyers. That would be a mistake.

Anything that dissuades international students from coming to Canada — and staying after they graduate — could have a significant knock-on effect on the economy.

Those students, after all, are helping to staff the science and engineering labs that are driving innovation at Canada’s universities and in the technology sector, and are a big part of the appeal of Canada to tech giants such as Google and potentially Amazon.

Reducing things to “us and them” could be costly indeed.

The role of NPR homebuyers is even more pronounced among those under 25 years old, who are more likely to be students in Canada than temporary workers. NPRs accounted for 10 per cent of all mortgages issued in 2016 to those under 25 in Vancouver and Toronto.

The past year has witnessed a sudden and significant increase in the number of international students applying to Canadian universities and colleges. The University of Alberta, for instance, has experienced an 82 per cent increase in applications from international graduate students.

Many experts believe this to be a response to the tightening of immigration regulations in the U.S. and a reaction to the rise of ultra-right-wing movements in Europe that has made Canada more attractive to international students.

Over the past few years, provincial governments in British Columbia and Ontario moved to combat rapidly escalating housing prices by targeting punitive taxes at foreign homebuyers. A further tightening of mortgage regulations also occurred at the same time, thus slowing house price escalation and reducing the number of transactions.

While foreign homebuyer taxes target non-residents, NPRs are essentially exempted since they can ask for a rebate later after satisfying residency requirements. And while most NPRs rent, a large number do purchase housing. The mortgage data from the big five banks reported by the CMHC suggests that NPRs account for a larger share of mortgages than do NROs.

A knee-jerk response to the CMHC report might be to consider eliminating exemptions for NPRs from taxes on foreign home buyers. That would be a mistake.

Anything that dissuades international students from coming to Canada — and staying after they graduate — could have a significant knock-on effect on the economy.

Those students, after all, are helping to staff the science and engineering labs that are driving innovation at Canada’s universities and in the technology sector, and are a big part of the appeal of Canada to tech giants such as Google and potentially Amazon.

Reducing things to “us and them” could be costly indeed.

Categories

Archives

- May 2022 (1)

- November 2021 (2)

- October 2021 (3)

- July 2021 (1)

- March 2021 (1)

- April 2020 (1)

- January 2020 (1)

- October 2019 (1)

- September 2019 (1)

- August 2019 (1)

- June 2019 (1)

- April 2019 (1)

- December 2018 (1)

- August 2018 (1)

- July 2018 (1)

- June 2018 (1)

- April 2018 (1)

- March 2018 (1)

- February 2018 (2)

- January 2018 (2)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- August 2017 (3)

- June 2017 (3)

- April 2017 (3)

- March 2017 (3)

- February 2017 (1)

- January 2017 (3)

- December 2016 (4)

- November 2016 (2)

- October 2016 (3)

- August 2016 (3)

- July 2016 (1)

- June 2016 (3)

- April 2016 (3)

- March 2016 (3)

- February 2016 (10)

- January 2016 (5)

- December 2015 (1)

- November 2015 (4)

- October 2015 (3)

- September 2015 (1)

- August 2015 (3)

- July 2015 (3)

- June 2015 (10)

- May 2015 (4)

- April 2015 (9)

- March 2015 (3)

- February 2015 (5)

- January 2015 (12)

- December 2014 (7)

- November 2014 (13)

- October 2014 (13)

- September 2014 (9)

- August 2014 (4)

- July 2014 (10)

- June 2014 (12)

- May 2014 (10)

- April 2014 (5)

- March 2014 (23)

Subscribe To This Blog

Subscribe To This Blog © 2004. An independently owned and operated broker member of Sutton West Coast Realty. Each office independently owned and operated.

Sutton and Sutton West Coast are service marks of Sutton West Coast Realty and are used herein under license. Mandeep Sendher is the licensed realtor at The BC Home Hunter Group and though he is not the owner of any BCHH domains, trademarks, branding or content he assumes 100% responsibility for any and all online and offline print material, artwork, reports etc. MANDEEP SENDHER is responsible for all problems and issues including this web site or other BCHH social media platforms or electronic communication.

All photos, artwork and materials are assumed to be in the public domain unless otherwise stated. Copyright claims will be honored upon specific identification of material and immediately dealt with upon request.

The content of this website is protected by copyright law. All rights reserved. Unauthorized use in any way, shape or form is prohibited. Information is deemed reliable but is not guaranteed. Maximum care has been put into the accuracy of the content, but specifications and details should be verified by the parties involved in transactions, and we are not liable for any losses whatsoever incurred as a result of information on this website.

You are not permitted to post on or transmit to or from this web site any unlawful, threatening, libellous, defamatory, obscene, inflammatory, pornographic or profane material, or other content that could give rise to civil or criminal liability under the law.

This web site does not grant you any rights to use our trademarks, service marks, logos, artwork or trade names. The content on this site is protected by copyrights, trademarks and service marks, other intellectual property laws, and other laws and regulations.

The design, layout, graphics, photography are copyrighted and the property of THE BC HOME HUNTER GROUP, and may not be reproduced and/or used for any purposes whatsoever, without written consent. THE BC HOME HUNTER GROUP does not claim to own the rights to any or all artwork, designs, photographs etc, found on this web site or any other or any social media unless otherwise stipulated.

BCHOMEHUNTER.COM

VANCOUVERHOMEHUNTER.COM

FRASERVALLEYHOMEHUNTER.COM

NORTHVANCOUVERHOMEHUNTER.COM

WHITEROCKHOMEHUNTER.COM

LANGLEYHOMEHUNTER.COM

CLOVERDALEHOMEHUNTER.COM

WESTVANCOUVERHOMEHUNTER.COM

PITTMEADOWSHOMEHUNTER.COM

BURNABYHOMEHUNTER.COM

COQUITLAMHOMEHUNTER.COM

DELTAHOMEHUNTER.COM

MAPLERIDGEHOMEHUNTER.COM

PORTMOODYHOMEHUNTER.COM

SURREYHOMEHUNTER.COM

SOUTHSURREYHOMEHUNTER.COM

FORTLANGLEYHOMEHUNTER.COM

MORGANHEIGHTSHOMEHUNTER.COM

604LIFE.COM

© 2004. An independently owned and operated broker member of Sutton West Coast Realty. Each office independently owned and operated.

Sutton and Sutton West Coast are service marks of Sutton West Coast Realty and are used herein under license. Mandeep Sendher is the licensed realtor at The BC Home Hunter Group and though he is not the owner of any BCHH domains, trademarks, branding or content he assumes 100% responsibility for any and all online and offline print material, artwork, reports etc. MANDEEP SENDHER is responsible for all problems and issues including this web site or other BCHH social media platforms or electronic communication.

All photos, artwork and materials are assumed to be in the public domain unless otherwise stated. Copyright claims will be honored upon specific identification of material and immediately dealt with upon request.

The content of this website is protected by copyright law. All rights reserved. Unauthorized use in any way, shape or form is prohibited. Information is deemed reliable but is not guaranteed. Maximum care has been put into the accuracy of the content, but specifications and details should be verified by the parties involved in transactions, and we are not liable for any losses whatsoever incurred as a result of information on this website.

You are not permitted to post on or transmit to or from this web site any unlawful, threatening, libellous, defamatory, obscene, inflammatory, pornographic or profane material, or other content that could give rise to civil or criminal liability under the law.

This web site does not grant you any rights to use our trademarks, service marks, logos, artwork or trade names. The content on this site is protected by copyrights, trademarks and service marks, other intellectual property laws, and other laws and regulations.

The design, layout, graphics, photography are copyrighted and the property of THE BC HOME HUNTER GROUP, and may not be reproduced and/or used for any purposes whatsoever, without written consent. THE BC HOME HUNTER GROUP does not claim to own the rights to any or all artwork, designs, photographs etc, found on this web site or any other or any social media unless otherwise stipulated.

BCHOMEHUNTER.COM

VANCOUVERHOMEHUNTER.COM

FRASERVALLEYHOMEHUNTER.COM

NORTHVANCOUVERHOMEHUNTER.COM

WHITEROCKHOMEHUNTER.COM

LANGLEYHOMEHUNTER.COM

CLOVERDALEHOMEHUNTER.COM

WESTVANCOUVERHOMEHUNTER.COM

PITTMEADOWSHOMEHUNTER.COM

BURNABYHOMEHUNTER.COM

COQUITLAMHOMEHUNTER.COM

DELTAHOMEHUNTER.COM

MAPLERIDGEHOMEHUNTER.COM

PORTMOODYHOMEHUNTER.COM

SURREYHOMEHUNTER.COM

SOUTHSURREYHOMEHUNTER.COM

FORTLANGLEYHOMEHUNTER.COM

MORGANHEIGHTSHOMEHUNTER.COM

604LIFE.COM