2017 B.C. Home & Real Estate Assessment Values & Info Story

(January 04, 2018

)

Here we are again folks - another new year and another taxation season is upon us. In the interest of unabashed neutrality we suggest taking a peek at your tax payer money at work by visiting the British Columbia  assessment authority web site to confirm the accuracy of your home or land's "value." Assessments can be appealed until Jan. 31, but we strongly advise all our clients to 'do their homework' first or have our experts do it on your behalf - we are always happy to be of assistance.

assessment authority web site to confirm the accuracy of your home or land's "value." Assessments can be appealed until Jan. 31, but we strongly advise all our clients to 'do their homework' first or have our experts do it on your behalf - we are always happy to be of assistance.

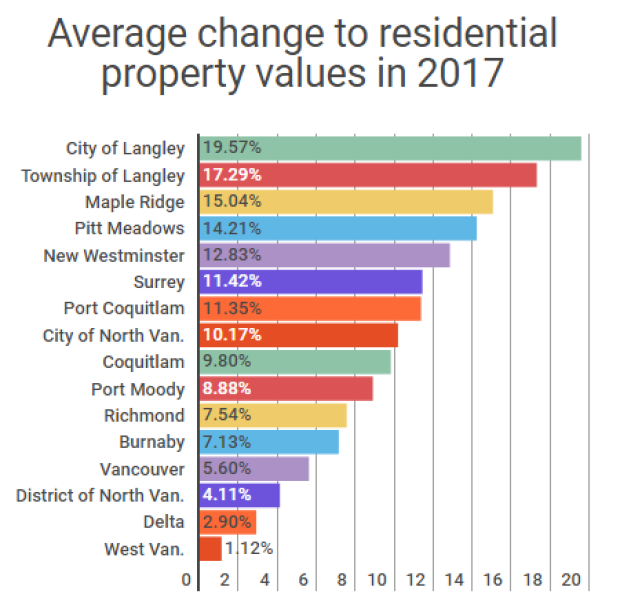

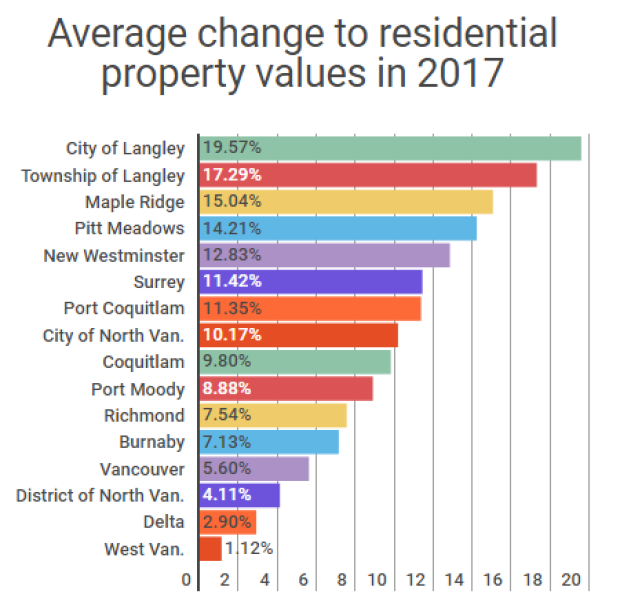

1. Condos are up, but detached homes are somewhat stagnant. For the first time in years, many single-family homes in Vancouver, the North Shore, Burnaby and Richmond went down in value (some went up, location, location, location) — some by as much as 10 per cent.

It confirms what figures have shown over the past year: The market for higher-end homes stagnated in the last half of 2016 and in 2017, following months of explosive growth.

But apart from detached homes in specific areas, the rise in property values continues unabated throughout the Lower Mainland.

"We reflect market conditions as of July 1, 2017, and there appears to be less demand for the single-family."

Instead, property taxes are based on the change in assessed values of the homes around it. If your property value goes up significantly more than the average increase in your municipality, your tax bill will see a significant hike as well.

Predictions are that condo owners will pay a greater share of property taxes than single-family owners in 2018 as compared to 2017. Not to mention Mayor Moonbeam and ultra left wing Vision Vancouver are dramatically increasing taxes and fees AGAIN. The North Shore, Burnaby, South Surrey, Pitt Meadows and nearly anywhere in the Fraser Valley offer substantially better investment opportunities than the city of Vancouver now does.

The day after the assessments were released, the socialist NDP government raised the homeowner grant to $1.65 million from $1.6 million, for strictly political reasons. After all, they need every inner city voter they can get their collective hands on.

assessment authority web site to confirm the accuracy of your home or land's "value." Assessments can be appealed until Jan. 31, but we strongly advise all our clients to 'do their homework' first or have our experts do it on your behalf - we are always happy to be of assistance.

assessment authority web site to confirm the accuracy of your home or land's "value." Assessments can be appealed until Jan. 31, but we strongly advise all our clients to 'do their homework' first or have our experts do it on your behalf - we are always happy to be of assistance.B.C. Assessment put a dollar value on 2,044,482 properties in this province last year. What does that really mean? It's a large number, and the sheer volume of data about B.C. property values that comes out every year at this time can be overwhelming. But aside from the fact that Chip Wilson's house continues to be astronomically valuable and for that matter David Suzuki's any pretty well anyone else's in Vancouver, here are a few other key facts to take away from this year's release of property data.

1. Condos are up, but detached homes are somewhat stagnant. For the first time in years, many single-family homes in Vancouver, the North Shore, Burnaby and Richmond went down in value (some went up, location, location, location) — some by as much as 10 per cent.

It confirms what figures have shown over the past year: The market for higher-end homes stagnated in the last half of 2016 and in 2017, following months of explosive growth.

But apart from detached homes in specific areas, the rise in property values continues unabated throughout the Lower Mainland.

"When you look at Richmond, there's been no changes in the single-family assessed values, yet the townhouse  market has gone up 15 to 20 per cent, and condos are upwards of 35 per cent," said Tina Ireland, an assessor with B.C. Assessment.

market has gone up 15 to 20 per cent, and condos are upwards of 35 per cent," said Tina Ireland, an assessor with B.C. Assessment.

market has gone up 15 to 20 per cent, and condos are upwards of 35 per cent," said Tina Ireland, an assessor with B.C. Assessment.

market has gone up 15 to 20 per cent, and condos are upwards of 35 per cent," said Tina Ireland, an assessor with B.C. Assessment."We reflect market conditions as of July 1, 2017, and there appears to be less demand for the single-family."

2. If your an Island Home Hunter that market is hot. There have been some suggestions that the property value boom in Metro Vancouver has created a spillover effect into smaller, more affordable communities — and the new figures show there might be some merit to that.

Don't forget the foreign buyers tax doesn't apply there.

There were 39 municipalities in B.C. where the average assessed value of residential properties rose more than 15 per cent in the last year. Just three of them were in Metro Vancouver, but 20 were on Vancouver Island.

3. Do your homework before appealing. Between one and two per cent of people file an appeal with B.C. Assessment every year (the deadline is Jan. 31), but property tax agent Paul Sullivan said people shouldn't file one without doing careful research ahead of time.

"It can end up being very time-consuming and a costly experience if you don't do your homework in advance," said Sullivan, adding that he doesn't see many people win cases.

"Just because it doubled doesn't give you an appeal."

There were 39 municipalities in B.C. where the average assessed value of residential properties rose more than 15 per cent in the last year. Just three of them were in Metro Vancouver, but 20 were on Vancouver Island.

3. Do your homework before appealing. Between one and two per cent of people file an appeal with B.C. Assessment every year (the deadline is Jan. 31), but property tax agent Paul Sullivan said people shouldn't file one without doing careful research ahead of time.

"It can end up being very time-consuming and a costly experience if you don't do your homework in advance," said Sullivan, adding that he doesn't see many people win cases.

"Just because it doubled doesn't give you an appeal."

UBC economics professor Tom Davidoff said appeals are especially tough for people who live in densely populated areas.

"If you've got a condo in Vancouver, I think they're going to get it pretty right, because there's so many homes they compare to yours, but out in the hinterlands, it gets thinner, and you have to believe if your home is unique in some ways, that they could botch the assessment."

4. Remember, your assessment increase isn't the same as your property tax increase.

"When your property value rises or falls, that doesn't really drive your property tax bill."

"If you've got a condo in Vancouver, I think they're going to get it pretty right, because there's so many homes they compare to yours, but out in the hinterlands, it gets thinner, and you have to believe if your home is unique in some ways, that they could botch the assessment."

4. Remember, your assessment increase isn't the same as your property tax increase.

"When your property value rises or falls, that doesn't really drive your property tax bill."

Instead, property taxes are based on the change in assessed values of the homes around it. If your property value goes up significantly more than the average increase in your municipality, your tax bill will see a significant hike as well.

Predictions are that condo owners will pay a greater share of property taxes than single-family owners in 2018 as compared to 2017. Not to mention Mayor Moonbeam and ultra left wing Vision Vancouver are dramatically increasing taxes and fees AGAIN. The North Shore, Burnaby, South Surrey, Pitt Meadows and nearly anywhere in the Fraser Valley offer substantially better investment opportunities than the city of Vancouver now does.

The day after the assessments were released, the socialist NDP government raised the homeowner grant to $1.65 million from $1.6 million, for strictly political reasons. After all, they need every inner city voter they can get their collective hands on.

There you have it folks, a brief but concise conversation about your property assessment. If you would like more information or are considering either selling or buying your home - don't hesitate to contact Mandeep Sendher and our friendly neighbourhood BC Home Hunter real estate experts anytime, 604-767-6736.

Categories

Archives

- May 2022 (1)

- November 2021 (2)

- October 2021 (3)

- July 2021 (1)

- March 2021 (1)

- April 2020 (1)

- January 2020 (1)

- October 2019 (1)

- September 2019 (1)

- August 2019 (1)

- June 2019 (1)

- April 2019 (1)

- December 2018 (1)

- August 2018 (1)

- July 2018 (1)

- June 2018 (1)

- April 2018 (1)

- March 2018 (1)

- February 2018 (2)

- January 2018 (2)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- August 2017 (3)

- June 2017 (3)

- April 2017 (3)

- March 2017 (3)

- February 2017 (1)

- January 2017 (3)

- December 2016 (4)

- November 2016 (2)

- October 2016 (3)

- August 2016 (3)

- July 2016 (1)

- June 2016 (3)

- April 2016 (3)

- March 2016 (3)

- February 2016 (10)

- January 2016 (5)

- December 2015 (1)

- November 2015 (4)

- October 2015 (3)

- September 2015 (1)

- August 2015 (3)

- July 2015 (3)

- June 2015 (10)

- May 2015 (4)

- April 2015 (9)

- March 2015 (3)

- February 2015 (5)

- January 2015 (12)

- December 2014 (7)

- November 2014 (13)

- October 2014 (13)

- September 2014 (9)

- August 2014 (4)

- July 2014 (10)

- June 2014 (12)

- May 2014 (10)

- April 2014 (5)

- March 2014 (23)

Subscribe To This Blog

Subscribe To This Blog © 2004. An independently owned and operated broker member of Sutton West Coast Realty. Each office independently owned and operated.

Sutton and Sutton West Coast are service marks of Sutton West Coast Realty and are used herein under license. Mandeep Sendher is the licensed realtor at The BC Home Hunter Group and though he is not the owner of any BCHH domains, trademarks, branding or content he assumes 100% responsibility for any and all online and offline print material, artwork, reports etc. MANDEEP SENDHER is responsible for all problems and issues including this web site or other BCHH social media platforms or electronic communication.

All photos, artwork and materials are assumed to be in the public domain unless otherwise stated. Copyright claims will be honored upon specific identification of material and immediately dealt with upon request.

The content of this website is protected by copyright law. All rights reserved. Unauthorized use in any way, shape or form is prohibited. Information is deemed reliable but is not guaranteed. Maximum care has been put into the accuracy of the content, but specifications and details should be verified by the parties involved in transactions, and we are not liable for any losses whatsoever incurred as a result of information on this website.

You are not permitted to post on or transmit to or from this web site any unlawful, threatening, libellous, defamatory, obscene, inflammatory, pornographic or profane material, or other content that could give rise to civil or criminal liability under the law.

This web site does not grant you any rights to use our trademarks, service marks, logos, artwork or trade names. The content on this site is protected by copyrights, trademarks and service marks, other intellectual property laws, and other laws and regulations.

The design, layout, graphics, photography are copyrighted and the property of THE BC HOME HUNTER GROUP, and may not be reproduced and/or used for any purposes whatsoever, without written consent. THE BC HOME HUNTER GROUP does not claim to own the rights to any or all artwork, designs, photographs etc, found on this web site or any other or any social media unless otherwise stipulated.

BCHOMEHUNTER.COM

VANCOUVERHOMEHUNTER.COM

FRASERVALLEYHOMEHUNTER.COM

NORTHVANCOUVERHOMEHUNTER.COM

WHITEROCKHOMEHUNTER.COM

LANGLEYHOMEHUNTER.COM

CLOVERDALEHOMEHUNTER.COM

WESTVANCOUVERHOMEHUNTER.COM

PITTMEADOWSHOMEHUNTER.COM

BURNABYHOMEHUNTER.COM

COQUITLAMHOMEHUNTER.COM

DELTAHOMEHUNTER.COM

MAPLERIDGEHOMEHUNTER.COM

PORTMOODYHOMEHUNTER.COM

SURREYHOMEHUNTER.COM

SOUTHSURREYHOMEHUNTER.COM

FORTLANGLEYHOMEHUNTER.COM

MORGANHEIGHTSHOMEHUNTER.COM

604LIFE.COM

© 2004. An independently owned and operated broker member of Sutton West Coast Realty. Each office independently owned and operated.

Sutton and Sutton West Coast are service marks of Sutton West Coast Realty and are used herein under license. Mandeep Sendher is the licensed realtor at The BC Home Hunter Group and though he is not the owner of any BCHH domains, trademarks, branding or content he assumes 100% responsibility for any and all online and offline print material, artwork, reports etc. MANDEEP SENDHER is responsible for all problems and issues including this web site or other BCHH social media platforms or electronic communication.

All photos, artwork and materials are assumed to be in the public domain unless otherwise stated. Copyright claims will be honored upon specific identification of material and immediately dealt with upon request.

The content of this website is protected by copyright law. All rights reserved. Unauthorized use in any way, shape or form is prohibited. Information is deemed reliable but is not guaranteed. Maximum care has been put into the accuracy of the content, but specifications and details should be verified by the parties involved in transactions, and we are not liable for any losses whatsoever incurred as a result of information on this website.

You are not permitted to post on or transmit to or from this web site any unlawful, threatening, libellous, defamatory, obscene, inflammatory, pornographic or profane material, or other content that could give rise to civil or criminal liability under the law.

This web site does not grant you any rights to use our trademarks, service marks, logos, artwork or trade names. The content on this site is protected by copyrights, trademarks and service marks, other intellectual property laws, and other laws and regulations.

The design, layout, graphics, photography are copyrighted and the property of THE BC HOME HUNTER GROUP, and may not be reproduced and/or used for any purposes whatsoever, without written consent. THE BC HOME HUNTER GROUP does not claim to own the rights to any or all artwork, designs, photographs etc, found on this web site or any other or any social media unless otherwise stipulated.

BCHOMEHUNTER.COM

VANCOUVERHOMEHUNTER.COM

FRASERVALLEYHOMEHUNTER.COM

NORTHVANCOUVERHOMEHUNTER.COM

WHITEROCKHOMEHUNTER.COM

LANGLEYHOMEHUNTER.COM

CLOVERDALEHOMEHUNTER.COM

WESTVANCOUVERHOMEHUNTER.COM

PITTMEADOWSHOMEHUNTER.COM

BURNABYHOMEHUNTER.COM

COQUITLAMHOMEHUNTER.COM

DELTAHOMEHUNTER.COM

MAPLERIDGEHOMEHUNTER.COM

PORTMOODYHOMEHUNTER.COM

SURREYHOMEHUNTER.COM

SOUTHSURREYHOMEHUNTER.COM

FORTLANGLEYHOMEHUNTER.COM

MORGANHEIGHTSHOMEHUNTER.COM

604LIFE.COM