Urban Versus Suburban I Metro Vancouver Versus Fraser Valley

(April 21, 2016

)

We have previously stated that YES the lower mainland's bi-polar real estate market is, well, insane! In fact, in the time it has taken to pen this article the price for a west side teardown in Vancouer probably doubled.

Many of the axioms and paradigm's of previous generations are no longer "the" prevailing rule "at the moment." (Insert shameless promotional plug here) All the more important you or anyone you know contact our group of urban and suburban real estate experts before you consider the purchase or sale of your home or any of our beloved British Columbia real estate.

Each year, home buyers across North America struggle with a familiar choice: They can pay more to live in a smaller urban property aka a concrete coffin condo, within walking distance to schools, shops and work; or pay less for a larger suburban home with a big backyard and ample parking, but have to hop in a car for just about everything they need. At first blush, it appears urban and suburban residents may simply have fundamentally different values and interests, but that may not be the case.

For many Canadians, the decision between city and suburb boils down to how strongly you weight three important factors—your money, your time and your overall lifestyle. No two families prioritize these in exactly the same way. Moreover, even the urban-suburban truths we hold to be self-evident—as in, it’s always cheaper to live in the suburbs—don’t tell the entire tale. Taking into consideration the over the top price for any urban detached home in Vancouver it is often more about being to afford not only the purchase price but also the insanely high taxes.

To help readers appreciate this we are going to explore some of the details of what single-family detached home life within or near each of Canada’s four largest cities is like.

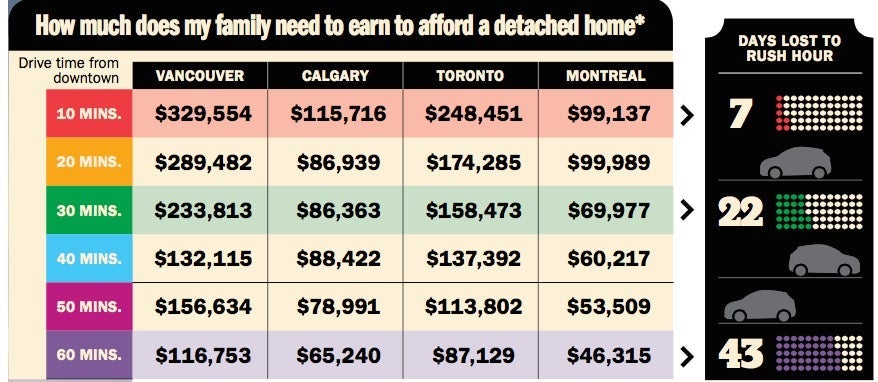

Detailed data on commute times, current average sale prices, living space and lot sizes—including a tricky calculation to tell us how much of a home’s value is currently locked into the land itself—were divided into layers spreading out from each downtown centre (we used City Hall to keep things consistent). Armed with this data, accurate analysis and forecasting models of just how much home and property you can expect to find the further you drive from downtown is available. Moreover, we can tell you how much it actually costs to live in each respective layer, factoring in average annual transit costs and property taxes. In other words the calculated firm figures to guide an important financial decision—in this case, one of the most important and emotional ones a person or family can make are now available for our BC Home Hunter buyers and sellers.

Some of our suspicions were confirmed: By and large, suburban homes are priced cheaper compared to urban homes. Duh. But there were surprises, too. Of the four cities looked at, Toronto is the only one where homes 20 minutes from the city core are smaller—by an average of 12%—than homes right downtown; Calgarians end up paying roughly the same price-per-square-foot for their living space whether they buy 30 or 60 minutes from the city centre; and in Vancouver, it can be more costly to live 50 minutes out than it is to live closer to downtown. (In all cases, we focused on data for single-family, detached homes.) For those of you that spend a disproportionate amount of time on the insanity known as lower mainland roads, highways and bridges your frustrations are also ours! Decades of anti car social engineering is and will continue to plague the metro areas so if your as annoyed as we are feel free to contact your city mayor and planners offices and if you voted for them, stop complaining!

In most cities across Canada, the premium to purchase a suburban-sized lot in an urban setting is beyond the reach of an average family. By all calculations, a downtown Vancouver home buyer would have to shell out roughly $3.3 million, for a property similar in size to what they could buy for half that price in Coquitlam, about a half-hour drive away if it's not raining and the entire driving population is on Prozac that day. Transplant a home from Mississauga into Toronto’s urban core and it would fetch close to $2.24 million, about $700,000 higher than what the average downtown home sold for in 2015. Don't forget the property and hidden city taxes respectively.

While affordability is important, there are other factors to consider. Larry Carloni, who currently resides in Gibsons, B.C., with his wife Kathryn, began to discuss the possibility of moving back to Calgary when his mom fell ill. “I grew up in the Haysboro community and I have such good memories,” says Larry. Based on their budget, they began looking at homes further from the city centre, but Larry wasn’t impressed with the options. “The homes that were more affordable were older, while the newer ones were just narrow rooms stacked on top of each other and built only a few feet away from the neighbour.” That’s when Larry and Kathryn looked to Okotoks, a community 40 minutes south of Calgary. “The home prices aren’t that different, but you can buy a newer, one-level home on a bigger lot and you have all the amenities you need for a normal life without the big city inconveniences.” One of those inconveniences, says Larry, is something he calls “the waiting game.” As in, a quick trip to the mall gets quickly kiboshed when you spend 20 minutes circling the parking lot. If you haven't read our previous report discussing the rise and fall of Alberta real estate prices you might want to before deciding to make the big move folks.

Some of the city dwellers spoken with were likewise shocked at how weekly, monthly or even one-off chores can take over a weekend when living downtown. While it’s true that many needs can be met by simply walking to the corner store or a nearby market, bigger tasks—such as getting material to hang shelves, getting everything on that large grocery list or completing your family’s back-to-school shopping—often requires a car, time and patience. There are relatively fewer large grocery stores within the city core—and even fewer big box stores. (In fact, that’s part of the appeal for diehard downtowners.) But for those living in the suburbs, where SmartCentres and strip malls are plentiful, it can be easier to complete mundane errands quickly and efficiently, leaving extra time to spend with family.

While Calgary commuters pay approximately $3,000 each year for gas and parking, home owners in other cities can expect to pay much more to commute, even if they don’t drive. Using today’s transit rates, a couple commuting 30 minutes (in non-rush hour traffic) one-way to Toronto’s downtown core could pay upwards of $6,000 each year, assuming optimal use of GO Train’s Presto card and TTC tokens. According to a report from the Centre for Economics & Business Research, that same couple will need to budget $1,260 more for commuting costs by the year 2030.

Even more shocking than the expense of commuting is the time spent travelling to and from work. According to our calculations a 10-minute commute to work (which, let’s be honest, is really 30 minutes during rush hour everywhere but Vancouver where its anywhere from 45 minutes+) is the equivalent of spending seven full days in transit each year. Increase that commute time to 60 minutes (or up to two hours each way during peak travel times) and you’re looking at 43 days spent in traffic. Of course, not every family has two commuters travelling downtown each day. One partner may work from home, or commute in another direction; this will greatly impact a family’s budget and schedule. Don't forget the insane gas prices in the lower mainland as well as guaranteed future rate hikes, tolls and every manner of invironmental and transit levies.

To get away from these long commute times, many Canadians are opting for walkable communities that offer nearby shopping, work, transit and amenities. Known in city-planner speak as “complete neighbourhoods,” these walkable neighbourhoods can be found in both urban and suburban settings. Just ask Alex Fuller. She doesn’t work in one of the four major cities we studied (Fuller works in Guelph, Ont., in human resources), but she did end up choosing to live in a suburb of Toronto—and ironically found the walkable neighbourhood she craved. As a single mom it was important for her to stay near family and friends, most of whom live in or near Burlington, Ont., about a 45-minute drive west of the city. She also wanted the ability to ditch her car on the weekends. “I wanted to raise my son with the convenience of downtown walkability but without the negative big-city influences,” such as drug-related crime and urban nightlife. So, she bought a cozy, detached home on a large lot in this bedroom city’s downtown.

Over the years her home became a hub. “Since we live so close to downtown, everyone meets and parks at my place. Then we all walk to where we want to go,” says Fuller. The location was great for her son. “The big backyard, coupled with a detached garage that we turned into a man cave, meant my house became the place to hang out—and that meant I could keep an eye on my boy without intruding on his space,” she says.

Fuller’s 45-minute commute to Guelph (she now works closer to home) sometimes made for stressful time when managing home and hockey schedules. To make it work, she had to arrange for a backup plan. “I was fortunate,” she says. “I can’t imagine what it would’ve been like to commute, get stuck and not have help.”

Fuller’s 45-minute commute to Guelph (she now works closer to home) sometimes made for stressful time when managing home and hockey schedules. To make it work, she had to arrange for a backup plan. “I was fortunate,” she says. “I can’t imagine what it would’ve been like to commute, get stuck and not have help.”

With walkability, school rankings, proximity to family, friends, shopping and outdoor spaces all integral to a house-purchasing decision, does that mean the days of maxing out a mortgage to buy the most floor space are over? Not quite. Despite all the advantages to reducing commute time and costs, when it comes to buying, many families experience sticker shock. Suburban homes are, by and large, significantly cheaper to purchase. But how much do you actually save? Once you factor in property taxes and transit costs, the answer is, well, complicated.

On average, a Toronto home owner will spend about $98,000 each year in mortgage payments, taxes and transit costs. Move 30 minutes out of the core and the carrying costs drop to $67,000. At 60 minutes away—Oshawa, Newmarket or Burlington—the annual costs drop to $46,000.

The same pattern exists for all four cities—with Vancouver homeowners forking out more than $121,000+ per year to cover housing and commuting costs downtown, compared to just over $91,000 to live 30 minutes away further out. While many love the idea of crime and noise riddled city living, it’s hard to ignore an annual savings of $30,000+.

Bear in mind: Calculating these costs required making many assumptions. For example, the commuting and transit costs for suburban homeowners assume one-car per family. Add a second car and you need to factor in gas, parking, insurance and maintenance. Here’s the thing: To get rid of a car and move closer to city transit would save approximately $200,000 over 25 years (the standard length of most mortgages). Those savings might put you in a different house cost bracket, or it could make a difference to you and your family in other ways; perhaps help you afford that dream family vacation or saving for a child’s education. Did someone say school catchments? Fraser Valley schools offer far less crowding and often far less social issues than their metro Vancouver counterparts.

Finding your sweet spot when it comes to urban-suburban living is not about how much a house costs or how large your yard is, though "happy wife happy life" is always of overarching importance folks—it’s about finding a house that allows you to get to work, run your errands and leaves you with enough time in your day (and money in your wallet) to enjoy your life. Some people will only be truly happy living outside the city, while others are content to pay for less if it gives them more time. That much has always been known, but armed with this data you may find your sweet spot might not be where you expect. Whatever direction your moving in, urban or suburban our passionate team at The BC Home Hunter Group definitely know your way home anywhere in the lower mainland or province!

Finding your sweet spot when it comes to urban-suburban living is not about how much a house costs or how large your yard is, though "happy wife happy life" is always of overarching importance folks—it’s about finding a house that allows you to get to work, run your errands and leaves you with enough time in your day (and money in your wallet) to enjoy your life. Some people will only be truly happy living outside the city, while others are content to pay for less if it gives them more time. That much has always been known, but armed with this data you may find your sweet spot might not be where you expect. Whatever direction your moving in, urban or suburban our passionate team at The BC Home Hunter Group definitely know your way home anywhere in the lower mainland or province!

Categories

Archives

- May 2022 (1)

- November 2021 (2)

- October 2021 (3)

- July 2021 (1)

- March 2021 (1)

- April 2020 (1)

- January 2020 (1)

- October 2019 (1)

- September 2019 (1)

- August 2019 (1)

- June 2019 (1)

- April 2019 (1)

- December 2018 (1)

- August 2018 (1)

- July 2018 (1)

- June 2018 (1)

- April 2018 (1)

- March 2018 (1)

- February 2018 (2)

- January 2018 (2)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- August 2017 (3)

- June 2017 (3)

- April 2017 (3)

- March 2017 (3)

- February 2017 (1)

- January 2017 (3)

- December 2016 (4)

- November 2016 (2)

- October 2016 (3)

- August 2016 (3)

- July 2016 (1)

- June 2016 (3)

- April 2016 (3)

- March 2016 (3)

- February 2016 (10)

- January 2016 (5)

- December 2015 (1)

- November 2015 (4)

- October 2015 (3)

- September 2015 (1)

- August 2015 (3)

- July 2015 (3)

- June 2015 (10)

- May 2015 (4)

- April 2015 (9)

- March 2015 (3)

- February 2015 (5)

- January 2015 (12)

- December 2014 (7)

- November 2014 (13)

- October 2014 (13)

- September 2014 (9)

- August 2014 (4)

- July 2014 (10)

- June 2014 (12)

- May 2014 (10)

- April 2014 (5)

- March 2014 (23)

Subscribe To This Blog

Subscribe To This Blog © 2004. An independently owned and operated broker member of Sutton West Coast Realty. Each office independently owned and operated.

Sutton and Sutton West Coast are service marks of Sutton West Coast Realty and are used herein under license. Mandeep Sendher is the licensed realtor at The BC Home Hunter Group and though he is not the owner of any BCHH domains, trademarks, branding or content he assumes 100% responsibility for any and all online and offline print material, artwork, reports etc. MANDEEP SENDHER is responsible for all problems and issues including this web site or other BCHH social media platforms or electronic communication.

All photos, artwork and materials are assumed to be in the public domain unless otherwise stated. Copyright claims will be honored upon specific identification of material and immediately dealt with upon request.

The content of this website is protected by copyright law. All rights reserved. Unauthorized use in any way, shape or form is prohibited. Information is deemed reliable but is not guaranteed. Maximum care has been put into the accuracy of the content, but specifications and details should be verified by the parties involved in transactions, and we are not liable for any losses whatsoever incurred as a result of information on this website.

You are not permitted to post on or transmit to or from this web site any unlawful, threatening, libellous, defamatory, obscene, inflammatory, pornographic or profane material, or other content that could give rise to civil or criminal liability under the law.

This web site does not grant you any rights to use our trademarks, service marks, logos, artwork or trade names. The content on this site is protected by copyrights, trademarks and service marks, other intellectual property laws, and other laws and regulations.

The design, layout, graphics, photography are copyrighted and the property of THE BC HOME HUNTER GROUP, and may not be reproduced and/or used for any purposes whatsoever, without written consent. THE BC HOME HUNTER GROUP does not claim to own the rights to any or all artwork, designs, photographs etc, found on this web site or any other or any social media unless otherwise stipulated.

BCHOMEHUNTER.COM

VANCOUVERHOMEHUNTER.COM

FRASERVALLEYHOMEHUNTER.COM

NORTHVANCOUVERHOMEHUNTER.COM

WHITEROCKHOMEHUNTER.COM

LANGLEYHOMEHUNTER.COM

CLOVERDALEHOMEHUNTER.COM

WESTVANCOUVERHOMEHUNTER.COM

PITTMEADOWSHOMEHUNTER.COM

BURNABYHOMEHUNTER.COM

COQUITLAMHOMEHUNTER.COM

DELTAHOMEHUNTER.COM

MAPLERIDGEHOMEHUNTER.COM

PORTMOODYHOMEHUNTER.COM

SURREYHOMEHUNTER.COM

SOUTHSURREYHOMEHUNTER.COM

FORTLANGLEYHOMEHUNTER.COM

MORGANHEIGHTSHOMEHUNTER.COM

604LIFE.COM

© 2004. An independently owned and operated broker member of Sutton West Coast Realty. Each office independently owned and operated.

Sutton and Sutton West Coast are service marks of Sutton West Coast Realty and are used herein under license. Mandeep Sendher is the licensed realtor at The BC Home Hunter Group and though he is not the owner of any BCHH domains, trademarks, branding or content he assumes 100% responsibility for any and all online and offline print material, artwork, reports etc. MANDEEP SENDHER is responsible for all problems and issues including this web site or other BCHH social media platforms or electronic communication.

All photos, artwork and materials are assumed to be in the public domain unless otherwise stated. Copyright claims will be honored upon specific identification of material and immediately dealt with upon request.

The content of this website is protected by copyright law. All rights reserved. Unauthorized use in any way, shape or form is prohibited. Information is deemed reliable but is not guaranteed. Maximum care has been put into the accuracy of the content, but specifications and details should be verified by the parties involved in transactions, and we are not liable for any losses whatsoever incurred as a result of information on this website.

You are not permitted to post on or transmit to or from this web site any unlawful, threatening, libellous, defamatory, obscene, inflammatory, pornographic or profane material, or other content that could give rise to civil or criminal liability under the law.

This web site does not grant you any rights to use our trademarks, service marks, logos, artwork or trade names. The content on this site is protected by copyrights, trademarks and service marks, other intellectual property laws, and other laws and regulations.

The design, layout, graphics, photography are copyrighted and the property of THE BC HOME HUNTER GROUP, and may not be reproduced and/or used for any purposes whatsoever, without written consent. THE BC HOME HUNTER GROUP does not claim to own the rights to any or all artwork, designs, photographs etc, found on this web site or any other or any social media unless otherwise stipulated.

BCHOMEHUNTER.COM

VANCOUVERHOMEHUNTER.COM

FRASERVALLEYHOMEHUNTER.COM

NORTHVANCOUVERHOMEHUNTER.COM

WHITEROCKHOMEHUNTER.COM

LANGLEYHOMEHUNTER.COM

CLOVERDALEHOMEHUNTER.COM

WESTVANCOUVERHOMEHUNTER.COM

PITTMEADOWSHOMEHUNTER.COM

BURNABYHOMEHUNTER.COM

COQUITLAMHOMEHUNTER.COM

DELTAHOMEHUNTER.COM

MAPLERIDGEHOMEHUNTER.COM

PORTMOODYHOMEHUNTER.COM

SURREYHOMEHUNTER.COM

SOUTHSURREYHOMEHUNTER.COM

FORTLANGLEYHOMEHUNTER.COM

MORGANHEIGHTSHOMEHUNTER.COM

604LIFE.COM